[ad_1]

Jamie Dimon has doubled down on his calls for the rich to pay more in income taxes. The JPMorgan CEO has long been a supporter of a more progressive taxation system, and his views have only been sharpened by the recent Trump tax breaks which favored the rich.

Dimon in the Rough: JPMorgan Chief Wants a Fairer America

In his annual letter to shareholders, the bank’s longstanding CEO reiterated his support for increasing taxes on the wealthy for the good of the country. Calling for an expansion of education and infrastructure budgets, Dimon argued that such a spending spree:

“… may very well mean taxing the wealthy more… If that happens, the wealthy should remember that if we improve our society and our economy, then they, in effect, are among the main winners.”

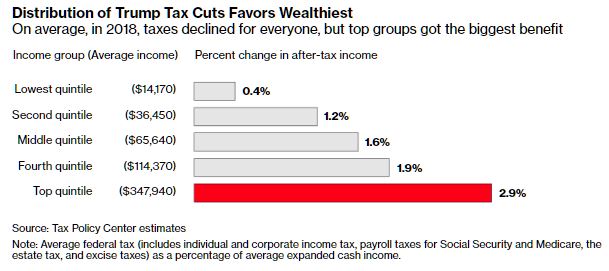

Trump Tax Cuts Cost $1.9 Trillion, Benefit Wealthy Most

The Trump administration’s regressive tax cuts came at an enormous price to the government’s purse strings, costing close to $2 trillion over ten years. According to the Tax Policy Center, the top quintile of American earners (those earning over $347,000 a year) benefited more than any other group of taxpayers.

Corporate tax rates were slashed from 35 to 21 percent.

Dimon says there are too many Americans struggling to make ends meet and unable to deal with unanticipated bills:

“Forty percent of American workers earn less than $15 an hour, and about 5% of full-time American workers earn the minimum wage or less, which is certainly not a living wage… In addition, 40% of Americans don’t have $400 to deal with unexpected expenses, such as medical bills or car repairs.”

Jamie Dimon Calls for a Fairer America

The CEO of a large and controversial corporate bank is not a typical source of advocacy for equality and fairness. But Jamie Dimon is cut from a different cloth. He told CNN Business last month that the American economy was failing minorities and the poor, despite its position as the world’s largest and most dynamic economy.

In his address to JPMorgan shareholders, Jamie Dimon took a stab at America’s education and criminal justice systems:

“No one can claim that the promise of equal opportunity is being offered to all Americans through our education systems, nor are those who have run afoul of our justice system getting the second chance that many of them deserve.”

Social Democracy – and Clintonomics – on the CEO’s Mind

Jamie Dimon’s plan is remarkably reminiscent of the Clintonomics of the 1990s. | Source: Shutterstock

Dimon went on to espouse the virtues of social democracy’s ability to combine market economics with strong social nets. In a backhanded swipe at traditional Republican dogma and the Trump administration’s appalling record on social justice, he argued:

“Republicans need to acknowledge that America should and can afford to provide a proper safety net for our elderly, our sick and our poor, as well as help create an environment that generates more opportunities and more income for more Americans.”

The far right may cringe, but the obviousness of the benefits – including to the wealthy – of wealthier households paying more taxes to subsidize healthcare and education for the less fortunate has been proven throughout modern economic history, from post-War Germany and Sweden right up to the booming years of the Asian Tigers in the 1960s to ’90s.

Jamie Dimon’s Keynesian message is pure Clintonomics: giving money to people who don’t have any stimulates economic growth because they will spend it. The disastrous tax law Donald Trump signed in December 2017 flies in the face of good public policy and a history of taxation systems that work for, and not against, taxpayers.

[ad_2]

Source link