[ad_1]

The bitcoin price just accomplished something it failed to do every day for more than a year, and it has speculators foaming at the mouth.

For the first time in 442 days, in nearly 15 months, a positive candle of bitcoin was closed on a chart that uses a technical analysis method called the Ichimoku Cloud, a collection of indicators that demonstrate support and resistance levels.

1D $BTC

442 days

it’s been 442 days since a daily candle close above the Cloud pic.twitter.com/8JoOOTSoeF

— Josh Olszewicz (@CarpeNoctom) April 3, 2019

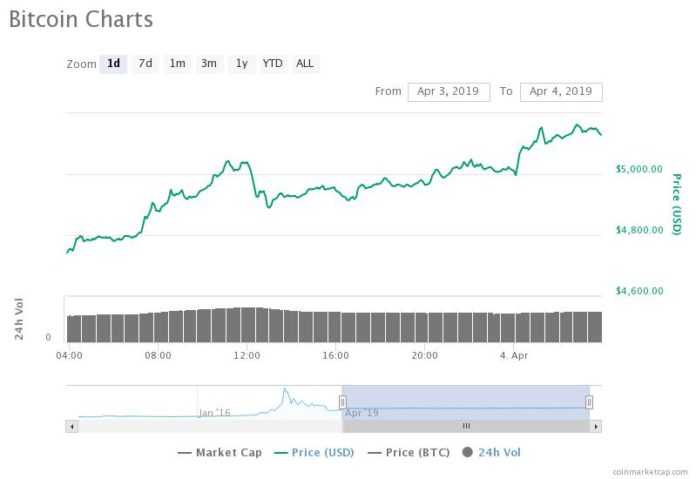

As bitcoin climbed over the $5,000 mark after surpassing a key resistance level at $4,200, it broke out of a 15-month bear trend, which some technical analysts argued was already broken when bitcoin recovered to mid-$4,000.

What’s Ahead For Bitcoin in 2019?

The bitcoin price rally in the past two days was primarily triggered by three factors:

- A short squeeze of $500 million worth of contracts on exchanges like BitMEX

- Buyers absorbing massive sell orders in the tune of hundreds of millions of dollars

- Lack of resistance above a key resistance level at $4,200

Typically, a strong short-term price movement of bitcoin is followed by a slight retracement, especially if the rally is larger than 10 percent, but the sheer momentum of the cryptocurrency market could allow major assets to continue to perform throughout the weeks to come.

In the near-term, market analyst David Puell suggested that the velocity of bitcoin may lead to the formation of a third cycle during which the dominant cryptocurrency increases in value.

In the first and second cycle, which occurred in 2011 and 2017, bitcoin recorded a return of over 10-fold.

“Still too little history to make definite conclusions, but Bitcoin velocity seems to be in the beginning phase of its third cycle as a mature asset with consistent internal economics. The fact that more economists aren’t interested in this stuff is flabbergasting to me,” Puell said.

Many technical indicators show that bitcoin has likely reached its bottom at $3,122 and is on track to enter an accumulation phase wherein the market gradually climbs to previous levels.

The recent rally of crypto, which began with bitcoin’s impressive 19 percent gain within a span of minutes, led the valuation of the crypto market to surge by $33 billion in merely two days.

The rally led cryptocurrencies in the likes of Bitcoin Cash, Litecoin, Augur, and Cardano to record gains in the range of 20 percent to 55 percent, with Bitcoin Cash remaining as the best performing crypto asset on the day.

Sentiment is Changing

The cryptocurrency market is still down about 80 percent from its all-time high at $815 billion, and bitcoin has a long way to go before recovering to $20,000.

But, the sentiment around cryptocurrencies seems to be rapidly improving with industry executives demonstrating confidence toward the prosperity of the cryptocurrency market.

This week, Barry Silbert, the founder of Digital Currency Group, arguably the most influential venture capital firm in the cryptocurrency sector, disclosed that Grayscale Investments surpassed $1 billion in assets under management.

Grayscale’s assets under management grew to over $1 billion today https://t.co/39KCiiGfKY

— Barry Silbert (@barrysilbert) April 2, 2019

It is also important to note that the sentiment around cryptocurrencies has started to change as bitcoin approaches its halving.

Historically, the bitcoin price has tended to rebound a year before its block reward halving, a mechanism which reduces the rate at which new coins are mined as the network approaches its fixed supply of 21 million BTC.

The next halving of bitcoin’s block reward is expected to occur in May 2020, which would mean that based on historical data, the asset could pick up momentum beginning next month.

[ad_2]

Source link