[ad_1]

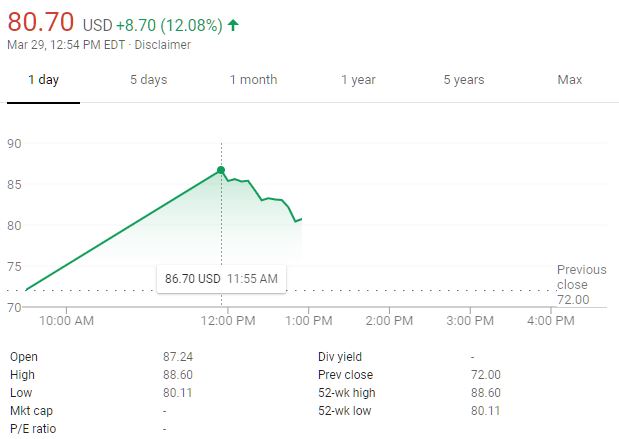

By CCN.com: Lyft is now a publicly traded company, and retail investors are clamoring for a slice. Shares roared at the open to $87, considerably higher than the $72 sale price. This 20% bump is an impressive showing, but is it enough to make Lyft a strong buy?

Retail Investors Pile into Lyft after Friday IPO

Already, the stock has given up 8% of these gains and is threatening a break below $80. One analyst believes it would be an absolute disastrous move to dive into the fray, and he took to Twitter to warn investors to stay far away from Lyft.

Josh Brown: Wall Street Hype Machine Pumps IPOs and Endangers Small Investors

Should I get into the $LYFT IPO? pic.twitter.com/OrA0rr5Ia3

— Downtown Josh Brown (@ReformedBroker) March 29, 2019

Hype and froth around well-televised public listings are extremely dangerous to retail investors. The point financial analyst Josh Brown makes is that retail investors already missed out on “the deal.”

“Take the hand that you are about to buy that stock with, and ball it up, [and] punch yourself in the face… All of the gain for these types of things…happens for the people that got in on the deal. You’re not in on the deal. You’re buying it from someone else in the after-market.”

Companies go public for many reasons, but primarily it is to make money for the founders. Lyft CEO Logan Green will own approximately 7.6 million shares, which equates to a rather tidy $650 million haul. Other founders will also now be in the nine-figure club. IPOs are not designed to make you money; they are carefully orchestrated and choreographed hype mechanisms.

Can they be profitable? Of course, but in the near-term wild volatility is to be expected. Trading bots know there will be an offering of fragile retail positions buying, while some early investors cash out. Crowded longs leave a potentially explosive bearish situation if things start sliding.

Moreover, there are some well-documented headwinds down the road for rideshare companies. In addition to the industry-specific hurdles, many economists believe that a recession could be coming in the US. This makes it a no brainer for Lyft to IPO this week, while valuations are still high and there is plenty of capital sloshing around looking for yield. All of these fundamentals tilt towards the idea that Lyft could be overvalued in the near term.

Lyft Must Avoid Being the Next Snapchat After Strong IPO

The SNAP IPO is a cautionary tale of the risks of buying into media hype and frenzy. | Source: Yahoo Finance

Don’t believe in the dangers of hype? Well, Snapchat (SNAP) was a cautionary tale for anyone who thinks a strong IPO means a great investment. A robust public offering was followed by a cratering of the share price.

Earlier, fellow social media giant Twitter suffered a similar fate.

Will Lyft Shares be Hurt or Helped by Uber?

Another risk to this picture is that when Uber launches it outperforms Lyft and starts sucking up capital. Right now, Lyft is the only public rideshare stock in town, which is another warning light that this is looking a bit bubbly. The stock could be up another 20% this time next year, but don’t ignore the risks that it might trade significantly lower than that, through no fault of the company itself.

The Nasdaq hype machine is the main enemy of a small investor, and Wall Street is great at herding the crowd. It ’s probably safer to wait for the dust to settle.

[ad_2]

Source link