[ad_1]

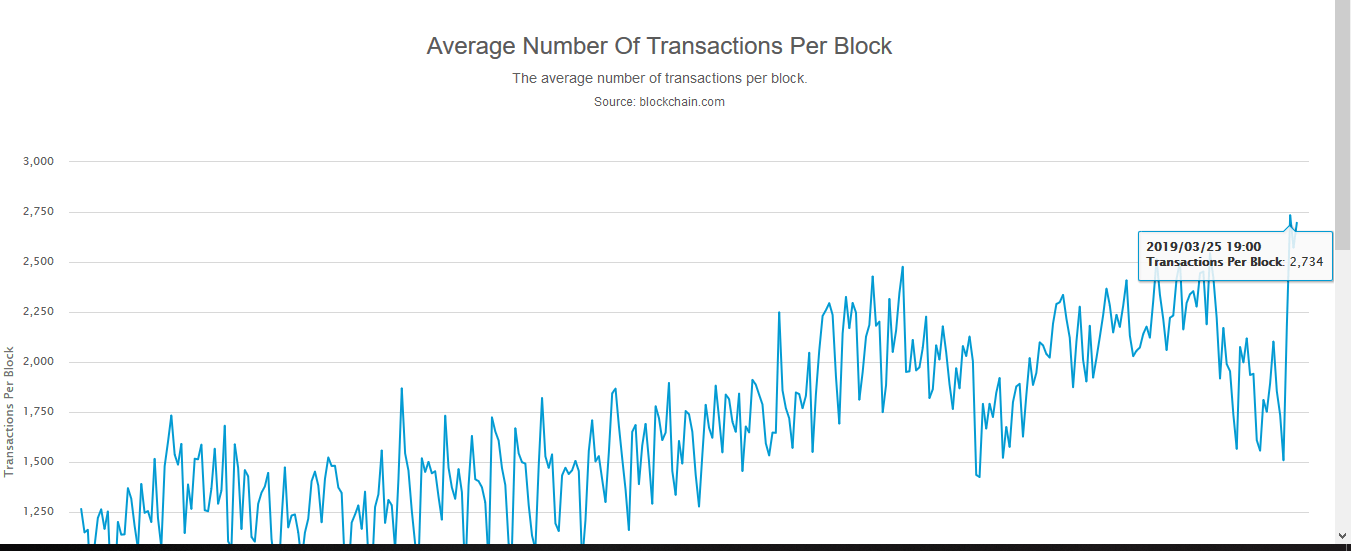

By CCN.com: The average transactions per Bitcoin block have gone to its all-time high in the past few days, and many people are attributing the rise in operations to a company called Veriblock. Veriblock is said to be creating as many as 20% of the total transactions on the Bitcoin blockchain at this time.

The average number of transactions per block is at ATH. Source: https://t.co/XAQailPunX #bitcoin pic.twitter.com/B86lkuh5Iv

— Gwented (@Gwented2) March 29, 2019

Veriblock: Proof of Spam?

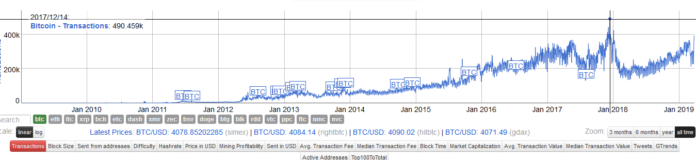

According to Blockchain.info, the current transaction rate is at its all-time high. The actual highest transactions ever recorded in a single day was back in December 2017, when, according to Bitinfocharts, transactions exceeded 420,000 in a single day.

According to Bitinfocharts, the rate of Bitcoin transactions is currently nearing its high of December 2017. The fees are nowhere near where they were then, however. | Image from Bitinfocharts.com

Veriblock went live a few days ago, and according to its block explorer, it currently represents almost 19% of the total Bitcoin transactions. People were already concerned about it when it was still in its testing stages.

If there were enough demand for Veriblock’s services, could it push up to 80% of all Bitcoin transactions?

According to Blockchain.info, average transactions per block have reached a new high. | Image from Blockchain.info.

What is Veriblock? It’s similar to Komodo in that it enables alternative blockchains to leverage the hashpower of the Bitcoin blockchain for security. The Komodo platform, however, requires fewer transactions to work out its delayed proof-of-work scheme. Veriblock calls their concept “proof of proof.” It describes itself as such:

“PoP mining enables blockchains to inherit and leverage the Proof of Work from a superior blockchain such as Bitcoin. As a result, the reinforced security provided by PoP will encourage further adoption of these alternative blockchains.”

Some people feel Veriblock is little more than blockchain spam, but it’s certainly not the type of spam that you want to complain about if you’re a miner. Blocks are full of fee-paying transactions as a result of Veriblock. The current feerate on Bitcoin is about 10,000 satoshi per kilobyte. It’s been a lot higher than that in times past.

Prepare for a Return to Massive On-Chain Bitcoin Fees

If the Bitcoin price happens to break out while Veriblock is still using a large amount of block space, we can expect fees to skyrocket. For Veriblock to remain a reliable service, it will be paying these higher fees.

The expected upcoming/impending bull run will likely propel some businesses to adopt the Lightning Network as a way to save money. But will users follow? This is an open question that will be determined by the actual usage of payment channels in the coming months and years. Certainly, alternative models of scaling, such as increased block size, will have their day in the court of meritocracy.

Ultimately, the more second-layer applications built on Bitcoin, the more valuable the minimal real estate of 1MB blocks will become. Lightning Network transactions eventually find their way onto the main chain in the form of channels opening and closing.

Proof of proof and other services developed by Veriblock take up space. And then thousands of companies have uses for Bitcoin block space. Will the small block stalwarts be pushed into re-opening the block size debate?

History shows that no number of unconfirmed transactions will sway them. However, if Lightning Network is fully put to work and blocks are still crowded, the question is bound to pop up again.

[ad_2]

Source link