[ad_1]

Touted as the next big thing in crypto, stablecoins promise investors volatility-proof exposure to decentralized assets, but insiders say that this emerging asset class is vulnerable to the same manipulative practices that have tarnished the broader ecosystem.

According to Nevin Freeman, chief executive officer of Reserve, a Coinbase-backed stablecoin, many of his rivals artificially inflate their market caps and trading volumes, creating misleading data on crypto-tracking sites like CoinMarketCap and The Stablecoin Index.

Freeman identified two dubious tactics used by stablecoin operators to pump their metrics: giving discounts to investors who agree to lock up their funds for a set timeframe; and encouraging “wash trading,” where traders simultaneously buy and sell the same cryptocurrency to inflate the appearance of volume and liquidity.

Paxos & Gemini Ignite Crypto Price War

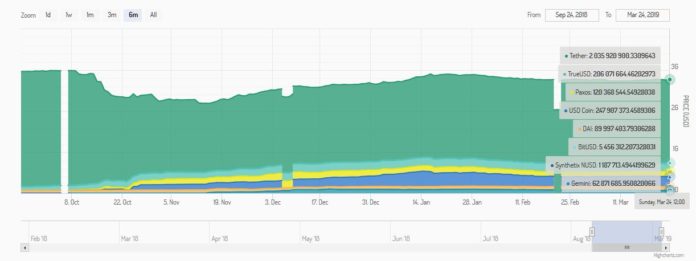

Reserve alleges that investors can’t trust what they see on crypto data sites. | Source: Stablecoin Index

Recent examples of discounting tactics include Paxos and Gemini, both of which offered select over-the-counter (OTC) trading desks 1% discounts last year to kickstart adoption. These discounts were predicated on OTC partners agreeing to hold their stablecoins for a predetermined “lock-up” period.

Reserve claims these rebate schemes are the reason PAX and GUSD activity surged last December, on both OTC desks and exchanges like Huobi and Binance. For example, GUSD’s market cap soared from roughly $87 million on December 17 to over $103 million the next day, according to CoinMarketCap data.

In the case of Paxos, their discount program coincided with the launch of HUSD, a pool of stablecoins offered by Singapore-based exchange Huobi, which enabled traders to swap stablecoins without actually trading them. This led to an arbitrage frenzy where certain traders tried to mass-withdraw PAX, even going as far as to creating dozens of dummy accounts to circumvent Huobi’s $10,000 withdrawal limit.

As Huobi launched HUSD, PAX’s market cap roughly doubled from $40 million to $80 million in a single day last October. Thus, critics like Freeman say that a lot of this market activity is being “manufactured.”

Tether’s Alleged Washing Machine

Highlighting the second dubious tactic is Tether, the seminal stablecoin. Tether has been dogged by allegations of wash trading, a practice that has been banned in regulated markets because it distorts real supply and demand.

In June 2018, Bloomberg alleged that the Tether cryptocurrency (USDT) was being wash-traded on crypto exchange Kraken (a claim the US crypto firm vehemently denied).

Despite losing nearly 30% of its grip on the stablecoin market last year, Tether still accounts for over two-thirds of the sector’s $3 billion market cap. Regardless, in light of these trends, Freeman believes that market cap and trading volume are “becoming bad metrics.”

The Stablecoin Industry & Goodhart’s Law

Freeman said such schemes are the epitome of Goodhart’s Law, an idea proposed by 20th Century British economist Charles Goodhart, which says that:

“When a measure becomes a target, it ceases to be a good measure.”

Applying Goodhart’s law to the stablecoin market, market cap and trading volume have become ends onto themselves to the detriment of the broader ecosystem. As the crypto industry evolves, Freeman hopes savvier investors will look to new metrics like the number of wallet addresses associated with a token, organic discussion about a project, and the number of consumer app downloads.

Ultimately, Freeman said that stablecoins with real-world applications beyond market arbitrage are best positioned for long-term success. Reserve, for its part, is targeting economically-challenged markets like Venezuela and Angola where people are vulnerable to hyperinflation and currency devaluation.

Freeman believes that stablecoins can help people in financially distressed countries to insulate their wealth from foreign-exchange shocks. Additionally, he said that stablecoins could facilitate a cheaper and more efficient model for remittance payments.

“Solving real-world problems, not financial engineering through arbitrage coins, is what is going to bring institutional legitimacy to the stablecoin market.”

[ad_2]

Source link