[ad_1]

The bitcoin price is demonstrating a similar movement as late 2018 and traders have started to express concerns over the extended stability of the asset.

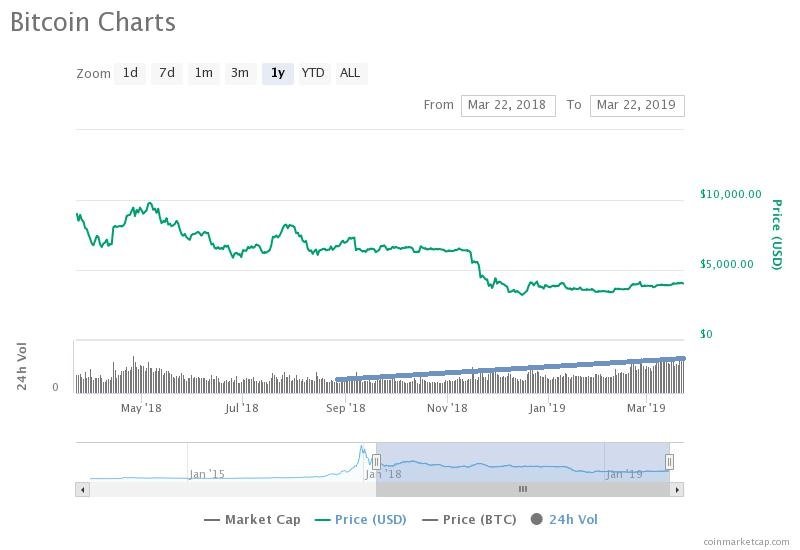

From early September to November, for more than three months, the bitcoin price remained stable in a tight range between $6,300 to $6,500.

However, in a matter of weeks, the bitcoin price plunged by around 50 percent from $6,500 to $3,200.

Join CCN for $9.99 per month and get an ad-free version of CCN including discounts for future events and services. Support our journalists today. Click here to sign up.

Is it just me or are we experiencing a mirrored version of what happened in front of $6000?$btc pic.twitter.com/smtmo2bGq1

— Crypto Hunter Gon (@CryptoxHunter) March 21, 2019

Some traders fear that a similar price movement may occur in the near-term if bitcoin fails to break out of key resistance levels in the $4,000 to $5,000 range.

Will Bitcoin Find a Way to Rebound?

One difference between the three-month period of stability in the last quarter of 2018 and the first quarter of 2019 is the daily volume of bitcoin across all major markets.

When bitcoin was hovering at $6,300, the daily volume of the dominant cryptocurrency and the cryptocurrency market, in general, was relatively low.

Since November of last year, the volume of bitcoin has recovered substantially and despite the reports about fake volumes in the cryptocurrency exchange market, identical exchanges existed six months ago so the landscape of the cryptocurrency exchange market remains the same.

Previously, in an interview with CCN, a well recognized technical analyst known as Bleeding Crypto said that the bitcoin price could retest $2,450 and go as low as $1,850.

He said:

I believe so because if you look at the chart on May of 2017 we maintained support at $2,450 region for months before we dipped to $1,850 and that marked the end of the BCH fork bearish trend. We shot up from there and we never came back and really re-tested that area $2,450.

So I believe like with most significant area of support, a test back is probably as price action tends to repeat itself. So a test back of $2,450 does not seem irrational.

Such a drastic downside movement would be possible if bitcoin becomes vulnerable and undergoes a similar movement as the last quarter of 2018.

However, there’s a variable in the cryptocurrency market. Unlike late last year, alternative cryptocurrencies have recorded large gains against both bitcoin and the U.S. dollar.

Several analysts have said that the strong performance of tokens and major crypto assets could help bitcoin regain momentum in the short-term.

Even as bitcoin struggled to cleanly break out of key resistance levels above the $4,000 level, alternative cryptocurrencies in the likes of Litecoin and Binance Coin have been able to maintain their momentum.

Moreover, some technical indicators of bitcoin have begun to indicate a positive upside movement for the first time since 2017, which could contribute to stimulating bitcoin in the weeks to come.

$BTC 3D is riding/holding above the 20MA on the @bbands, for the first time since end of 2017 Bull Trend

— Crypto Thies (@KingThies) March 17, 2019

Weak Performances Across the Board

In the last 24 hours, most cryptocurrencies experienced losses in the range of 2 to 8 percent against the U.S. dollar as bitcoin retraced to $4,000.

Major crypto assets such as bitcoin, Ethereum, Ripple, Litecoin, and EOS recorded an average loss of about 2 percent.

A slight retrace in the price of BTC was somewhat expected as the asset has found it challenging to cleanly break out of the $4,000 level throughout the past three months.

Currently, analysts generally foresee two scenarios for bitcoin: either quickly surpass key resistance levels and eliminate the possibility of dropping to mid-$3,000 or risk facing a similar movement as November 2018 during which it dropped by around 50 percent.

Click here for a real-time bitcoin price chart.

[ad_2]

Source link