[ad_1]

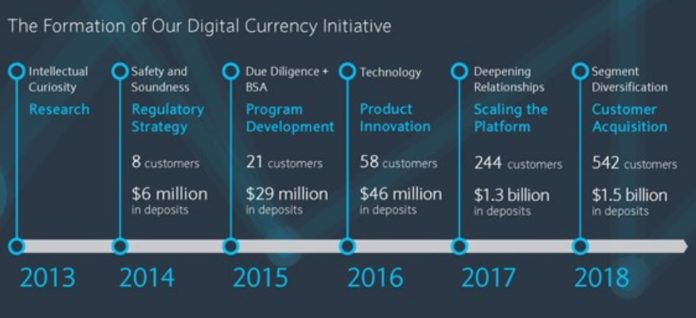

Silvergate Bank, which bills itself as the “leading provider of innovative financial infrastructure solutions and services to participants in the digital currency industry,” has disclosed in a preliminary prospectus filed with the U.S. Securities and Exchange Commission that despite the bearish conditions in the bitcoin market, its number of crypto industry clients surged in 2018.

Silvergate Crypto Client Deposits Rise to $1.58 Billion

By the end of last year, Silvergate revealed that it had 542 cryptocurrency-related customers. This was an increase of 122.1 percent from 2017 when the total number of customers was 244, per the prospectus. Total deposits also increased approximately by 8 percent from $1.46 billion to $1.58 billion.

Join CCN for $9.99 per month and get an ad-free version of CCN including discounts for future events and services. Support our journalists today. Click here to sign up.

Additionally, Silvergate disclosed that it was also in the process of onboarding some 232 customers.

Key Clients? Bitcoin Exchanges and Institutional Investors

Among its most notable customers, digital currency exchanges had deposited $618.5 million by the close of 2018. Institutional investors deposited $577.5 million. Some of the cryptocurrency firms that Silvergate counts as clients include Genesis, Circle, and Bitstamp.

Other clients include digital asset proprietary trading and investment firm Kenetic Capital and crypto-investment fund Polychain Capital. Hong Kong-based bitcoin storage firm Xapo and the firm behind the PAX stablecoin, Paxos, are also Silvergate’s clients.

The San Diego, California-based financial institution stands out alongside Europe’s Bank Frick and United States’ Signature Bank as some of the few banks in the world that have embraced crypto businesses according to Bloomberg.

The crypto bank estimates that the addressable market for dollar deposits related to cryptocurrencies is “approximately $30 to $40 billion.” Silvergate has consequently expressed hope that there is a lot of headroom for growth.

What to Worry About as a Prospective Investor in Silvergate

Despite this optimism, Silvergate warned prospective investors of the risks in the cryptocurrency sector:

“Our business is subject to many substantial risks and uncertainties you should consider before deciding to invest in our common stock … including risks that that the digital currency industry may not gain widespread adoption, that legal and regulatory uncertainty regarding the regulation of digital currencies and digital currency activities may inhibit the growth of the digital currency industry, that our low-cost funding strategy may not be sustainable, that our deposits may be adversely affected by price volatility.”

Silvergate Bank’s parent company, Silvergate Capital, began preparations for an initial public offering last year in November.

‘Crypto Bank’ Silvergate Files for $50 Million IPO https://t.co/8YFQinJYC8

— CCN.com (@CCNMarkets) November 21, 2018

As noted in the prospectus, Silvergate intends to use the proceeds of the IPO to fund organic growth as well as financing operations. While the bitcoin bank has left open the possibility of making future acquisitions, there are currently no such plans.

[ad_2]

Source link