[ad_1]

If you trade cryptocurrency, reporting your gains or losses at tax time is not only a smart thing to do– it’s a must. If you earned a profit, failing to disclose it will come back to haunt you later. At the same time, you could be eligible for a tax rebate if your 2018 trading activity resulted in a net loss.

The latest update to the most powerful crypto tax calculator on the market makes it even easier to use, no matter what your level of experience is. The addition of new accounting methods, improved API support, streamlined deposit/withdrawal reconciliation and a new IRS form 8949 attachment option are just a few of the latest changes.

All of the updates listed below are already live. Create a free CoinTracking account today and test out the new features for yourself.

CoinTracking.info: the tool of choice for cryptocurrency CPAs

Crypto Tax Girl Laura Walter is just one of several CPAs that prefer CoinTracking. The reason: it’s simply the most powerful and most versatile crypto tax tool available.

“I have tried over 20 different crypto tax softwares, and CoinTracking is the best by far. I have used CoinTracking to prepare crypto gain & loss reports for over 100 clients, and it has been able to handle every type of trader. I have worked with clients who have just a couple hundred trades, and I have worked with clients who have over 100,000 trades. I have worked with clients who have complete and perfect data and some who have lost half of their data or aren’t able to access it anymore, and CoinTracking has worked for all of them. And in addition to being able to create the gain & loss reports for taxes, CoinTracking also provides useful reports on unrealized gains & losses, current holdings, balances per exchange, etc. that I use frequently for tax planning purposes in order to help my clients minimize their tax liability now and in months and years to come.” – Laura, Founder of Crypto Tax Girl

Here is a brief overview of few of the latest updates to the software.

Hassle-free data management

Calculating how much you owe in taxes can get complicated fast– particularly if you deposited gifts, mining rewards or payments for services into the same cryptocurrency wallet that you use for placing trades. If your income isn’t correctly labeled, your return won’t make sense.

Easier deposit/withdrawal reconciliation

If you use your crypto wallet for more than just trading cryptocurrencies, you have to go back and identify each time you deposited mining rewards and any other type of crypto income before you submit. This can be a big hassle, particularly if you haven’t been keeping track as you go.

Here is a brief overview of few of the latest updates to the software.

Hassle-free data management

Calculating how much you owe in taxes can get complicated fast– particularly if you deposited gifts, mining rewards or payments for services into the same cryptocurrency wallet that you use for placing trades. If your income isn’t correctly labeled, your return won’t make sense.

Easier deposit/withdrawal reconciliation

If you use your crypto wallet for more than just trading cryptocurrencies, you have to go back and identify each time you deposited mining rewards and any other type of crypto income before you submit. This can be a big hassle, particularly if you haven’t been keeping track as you go.

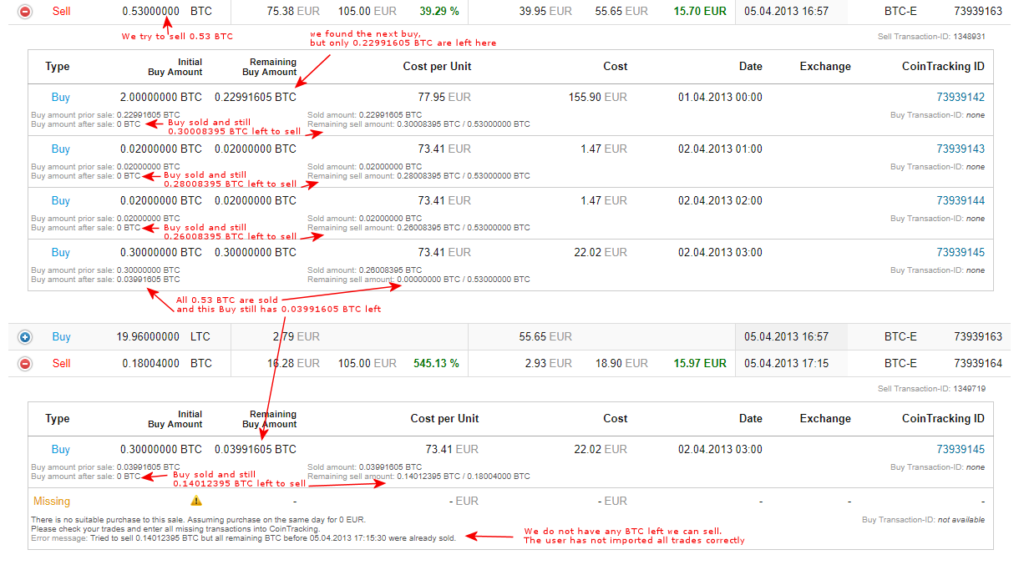

A new tool called Missing Transactions lets you instantly identify any outstanding deposits or withdrawals without using a spreadsheet. All you have to do to reconcile your deposits and withdrawals is connect your crypto wallet or exchange account to CoinTracking, import your data and run the report.

Scan and eliminate duplicate transactions

Another ease-of-use improvement is the addition of a new duplicate transaction checker called Duplicate Transactions. This tool scans all the data that you imported to see if you accidentally entered in a transaction twice.

Even better API support

One of the main reasons why professionals prefer CoinTracking is the fact that no other crypto tax calculator has better support for cryptocurrency exchange APIs. API data imports are more accurate than other data import methods, like CSV imports.

Since exchanges often change their APIs, staying on top of those updates requires a level of commitment that competing crypto tax calculators lack. Bitfinex, HitBTC, and Binance are just a few exchanges that recently altered their APIs. Each API change was quickly met with an update to CoinTracking’s API import feature. In addition, CoinTracking recently added API support for Cobinhood, BitMex, itBit and several other exchanges.

Less paperwork for US-based crypto traders

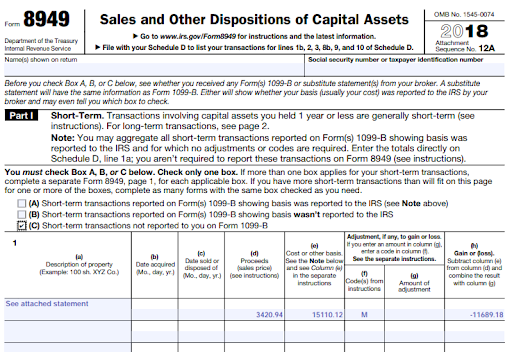

Previously, US-based CoinTracking users had to export multiple 8949 forms if the number of trades that were placed exceeded the number of lines on the page. Now, you can opt to send in an attachment with your 8949 instead. This greatly reduces the amount of paperwork that you have to worry about when you do your taxes. Alternatively, you can opt to group all your coins into one transaction line– another paperwork-reducing improvement.

New features for UK and Canadian traders

Before the recent update, CoinTracking already had more accounting methods that any other crypto tax calculator. The addition of ACB (Adjusted Cost Basis) makes it easier for Canadians to use CoinTracking. ACB is the accounting method that the Canada Revenue Agency requires Canadians to use when determining capital gains or losses for income tax purposes.

In addition to ACB, CoinTracking now features the accounting methods that the HMRC requires UK citizens to use. The default tax accounting method that Brits use is called traditional accounting. Some traders may be able to use cash basis accounting. CoinTracking supports both methods.

DrakeSoftware integration

DrakeSoftware — a tax software solution that caters to CPAs and businesses with features like support for nearly every IRS tax form– now integrates with CoinTracking. If you own an accounting firm or blockchain business, CoinTracking and DrakeSoftware make it easy to generate all the paperwork that you’re obligated to submit at tax time.

Audit your return before you submit

CoinTracking’s new Roll Forward Report feature is an auditing tool that lets you make sure that your return makes sense before you submit. The report detects if there is any missing data that you should provide with your return before you file.

If you took a loss in cryptocurrency markets in 2018, you may be eligible for a generous tax write-off. The IRS currently lets US citizens deduct up to $3000 in crypto losses from your day job income. What’s more, there’s no limit to how much you can deduct from income gained from property sales, stock trading and other types of capital gains.

There’s no better tool to use for determining your tax situation than CoinTracking. Our commitment to upgrading and improving the software has helped us accumulate an excellent reputation within the cryptocurrency community since 2014 and more than 370,000 users. Get started for free and connect all your exchange accounts today.

[ad_2]

Source link