[ad_1]

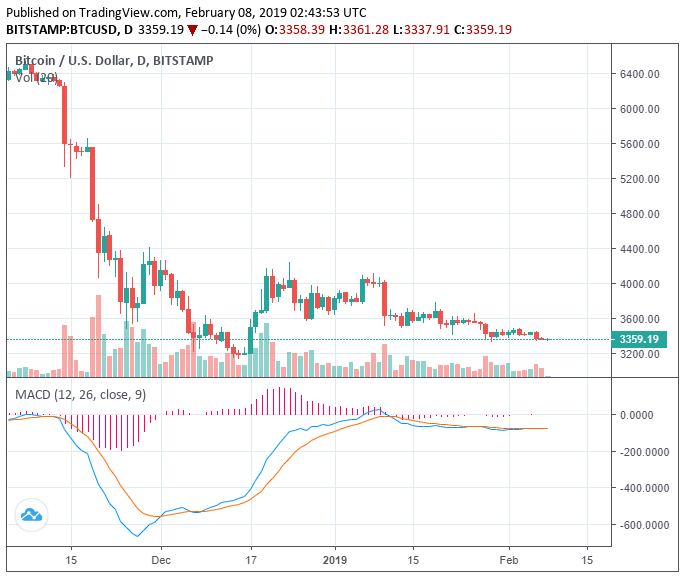

In the last 72 hours, the cryptocurrency market has been relatively stable at $111 billion as the Bitcoin price initiated no major movement.

Bitcoin has struggled to break out of key resistance levels or drop below crucial support levels, demonstrating a stalemate for well over three weeks.

Since January, Bitcoin has remained in a low range between $3,200 to $4,000, unable to engage in any meaningful short-term price movement.

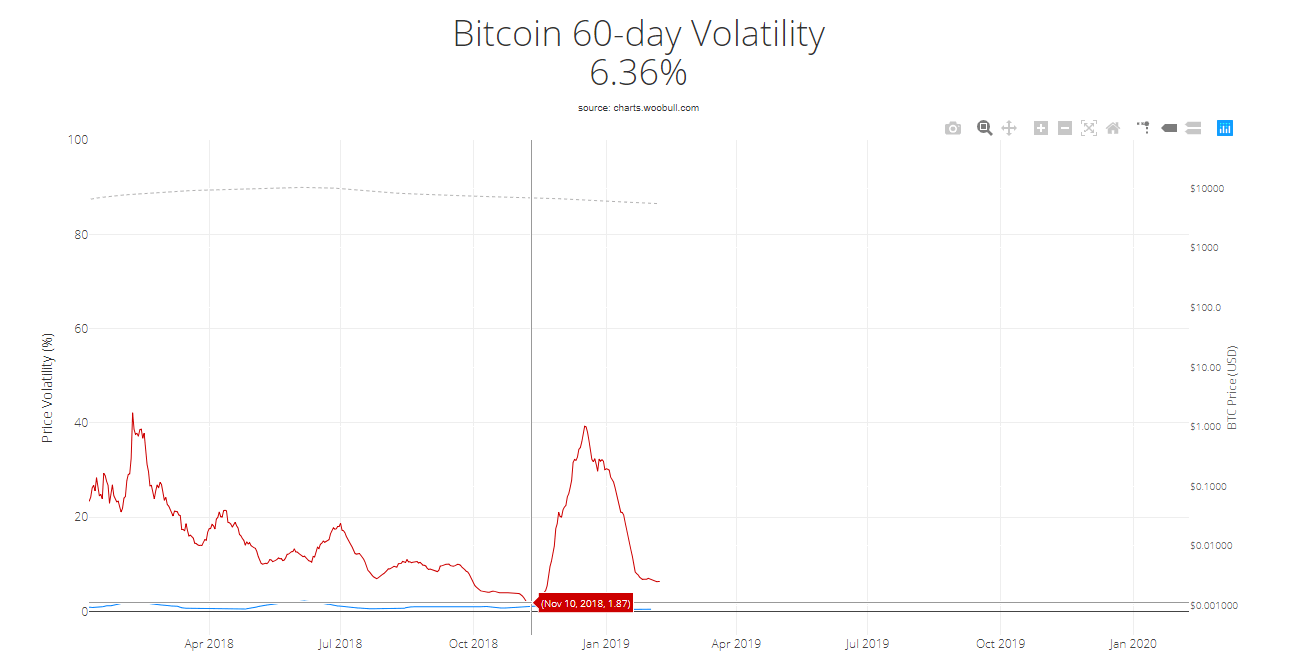

Bitcoin Volatility Dropping May Mean Bad News

The volatility of Bitcoin has dropped significantly since mid-January as the dominant cryptocurrency showed stability in a tight range in the low region of $3,000.

$BTC volatility in free fall. Nearly as low as lowest volatility recorded by this index back in November. pic.twitter.com/zL9ntksqrP

— Luke Martin (@VentureCoinist) February 7, 2019

The last time the volatility of Bitcoin recorded a free fall was in November. Following a stable few weeks, the price of BTC went on to plunge from $6,500 to $3,122 within 1 month.

In a relatively short period of time, the price of BTC dropped by more than 51 percent.

Already, analysts have begun to lower their forecasts in the short-term performance of BTC.

Fundstrat, a firm led by Tom Lee, a Wall Street analyst who consistently stated that Bitcoin would reach $25,000 as recently as January 28, set a price target for BTC at $2,270.

Robert Sluymer, a Fundstrat Global Advisors market strategist, said:

“The price structure for most cryptocurrencies remains weak and appears vulnerable to a pending breakdown to lower lows. Fundstrat’s advance/decline indicator is at risk of breaking to new lows.

A break below the fourth-quarter lows at $3,100 would imply a decline to $2,270, while a move above $4,200 is needed to signal Bitcoin is beginning to improve.”

Similarly, highly regarded cryptocurrency traders such as DonAlt and The Crypto Dog have said that Bitcoin is likely to fall to the low $2,000 region if it fails to recover beyond $4,000 in the foreseeable future.

But, although the next likely move for BTC is to demonstrate a lower level of momentum in the upcoming weeks, The Crypto Dog noted that it is still a risky period to short the asset.

“Shorting [Bitcoin at] 33XX is like shorting 63XX. Maybe the floor breaks on this go, or maybe you’re going to be wrong 5 times in a row. (Maybe it never breaks) Holding a short from higher up – yeah that’s perfectly reasonable.”

Hsaka, a cryptocurrency technical analyst, also suggested that it is difficult to short Bitcoin because it is defending the $3,300 support level with relative strength.

Wouldn’t short this right now.

• Sitting at daily support

• Consolidation (3340 -3480) lows taken.

• Beginning to round off.If we do pump, interested to see how price reacts to the 3440-3450 zone. pic.twitter.com/oNwW0EFCV9

— Hsaka (@HsakaTrades) February 7, 2019

A problem could occur if Bitcoin continues to show stability in a low tight range and the price trend of major crypto assets stagnates.

Previously, Mark Dow, a trader who shorted Bitcoin from its all-time high, emphasized that if BTC does not recover to $6,000 swiftly, it could spell trouble for the asset in the short-term.

“Still a beautiful chart. If bitcoin can’t bounce to at least $5k – $6k soon, it’s a really bad sign for the cyberbulls. And if it breaks down thru the yellow line at any point, even the HODLers need to GTFO,” Dow said.

Hence, even if BTC does recover to $4,000, it is not in the all-clear to declare a proper bottom and enter a consolidation period.

Crypto Markets Need Some Volatility

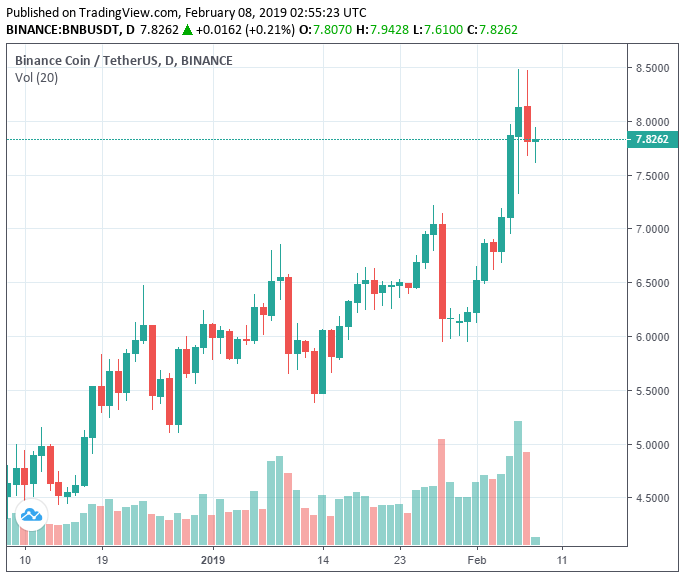

A handful of tokens in the likes of 0x, ICON, Aelf, and Chainlink have shown decent gains against both Bitcoin and the U.S. dollar in the past several days.

Binance Coin, for instance, which recently became the 10th most valuable cryptocurrency in the global market, increased by 25 percent against the USD from $6.25 to $7.84 in the last seven days.

Due to the bear market, cryptocurrencies have started to show some independent movements, which could be considered a positive element in the long-term growth of the sector.

However, it may also lead many crypto assets to fall by large margins against the USD while a handful defend key support levels, leading to a short-term bloodbath.

Click here for a real-time bitcoin price chart.

Featured Image from Shutterstock. Price Charts from TradingView.

[ad_2]

Source link