[ad_1]

The Dow Jones Industrial Average struggled on Monday, dropping more than 100 points after Boeing and several other major components lurched into the red. Tech giant Apple provided a bright spot, though, which helped the DJIA mount a slight recovery from its session low.

Here are five stocks moving the Dow as the US stock market heads into the afternoon session.

1. Boeing Tailspin Worsens

The Dow’s largest component, Boeing, continues to place severe downward pressure on the index.

Shares for the aerospace giant crashed by more than 4 percent on Monday after Boeing announced that it would slash 737 production by almost 20 percent while it focuses its efforts on fixing faulty software that contributed to two fatal 737 MAX 8 crashes in a span of less than five months.

Bank of America Merril Lynch analyst Ronald Epstein responded by downgrading BA from “Buy” to “Neutral” and reducing his price target by $60 to $420. He warned that Boeing’s 737 MAX line could face permanent reputational damage, even after it is certified as airworthy.

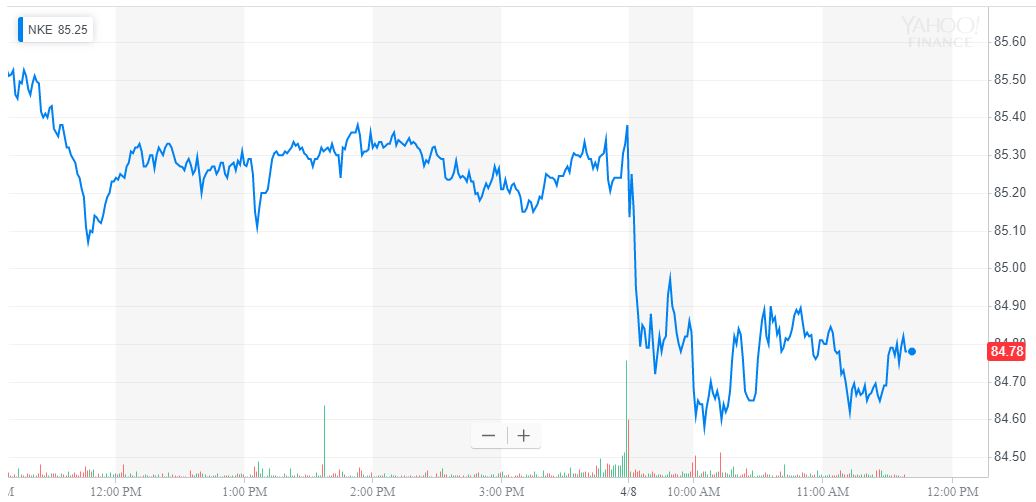

2. Nike Weathers Another (!) Zion Williamson Scandal

Nike shares fell after Michael Avenatti dropped a bombshell claim about the company’s relationships with NCAA players. | Source: Yahoo Finance

Further adding to the Dow’s bearish outlook was sports apparel company Nike whose shares dropped 0.8 percent.

The decline followed celebrity lawyer Michael Avenatti’s bombshell claim that Nike bribed more than 100 NCAA student-athletes to attend approved colleges, committing more than 200 criminal violations in the process. The most shocking claim, which Avenatti shared in a 41-page document drop, was that Nike made illegal payments to Sharonda Sampson, the mother of Duke Blue Devils forward and future NBA superstar Zion Williamson.

2/2 – Nike should be criminally indicted on well over 200 counts and should also explain why they misled their investors/the SEC. If I’m lying or the docs are not legit, I challenge @nike to issue a stmt claiming no bribes were ever paid. Just Do It Nike!https://t.co/4gi8MQRcQB

— Michael Avenatti (@MichaelAvenatti) April 6, 2019

Nike refused to respond to the shocking claim, noting that Avenatti is currently facing federal charges for allegedly attempting to extort $20 million from Nike.

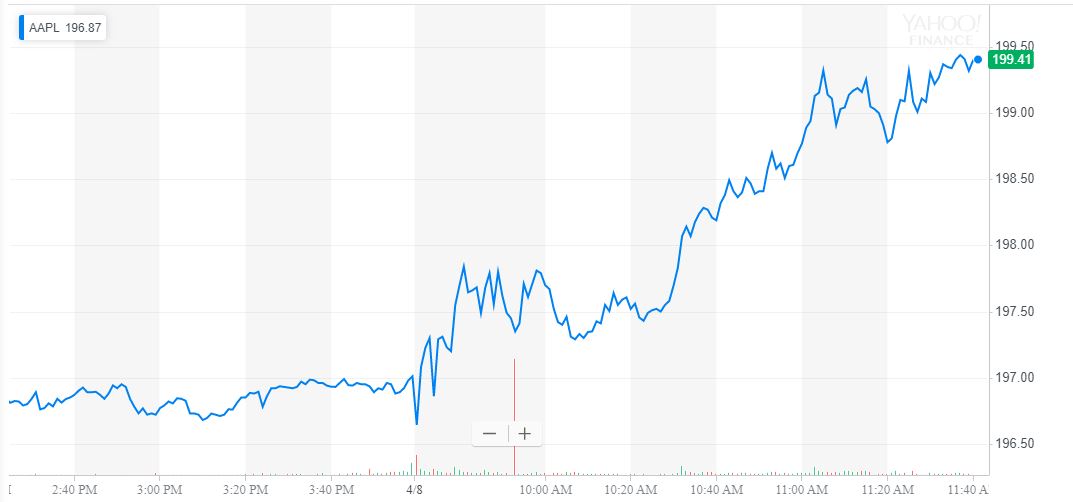

3. Apple Provides the Dow with Some Relief

The Dow’s losses were mitigated by a strong showing from several other index components, most notably Apple.

Apple stock rose 1.15 percent to $199.26 after industry blog Macotakara reported that the tech giant will launch several new iPhone models in 2019 featuring OLED screens and a third camera sensor on the back.

4. Dow Inc. Bounces Back

The DJIA’s newest index component, Dow Inc., climbed 1.33 percent as it bounced back from a dreadful showing on Friday.

The company, which replaced DowDupont in the DJIA following its recent spin-off, had plunged by 5.2 percent during last week’s final trading session after JPMorgan stunned investors by slapping it with an “underweight” rating.

5. Procter & Gamble Surges to 52-Week High

Further bolstering the Dow, Procter & Gamble shares pounded to a new 52-week high today, rising as high as $105 before settling at $104.86 for a session gain of 1.17 percent.

The move appeared to follow Wells Fargo’s decision to upgrade PG shares to “outperform” from “market perform.” Analysts explained the rating in a noted cited by CNBC:

“We are upgrading PG to an Outperform rating. We believe PG has changed and a sense of urgency & accountability has been infused into the organization, driven by CEO David Taylor. This is a far cry from the old PG, which we believe suffered from a lack of focus and agility, resulting in inconsistent execution. While it took a while for consistent results to show, fundamentals appear to have turned (highlighted by +4% org sales growth in F1H19). ”

[ad_2]

Source link