[ad_1]

China’s plans to ban bitcoin mining could not have come at a worse time for Bitmain. Once seemingly indomitable, Bitmain is now in a precarious phase.

In the past couple of months, the bitcoin mining hardware giant has not only reported a $500 million loss after a couple of years of consistently making profits but also failed in a bid to get publically listed.

Though recent leadership changes have given rise to hopes that the Bitmain ship could be steered back into the right track, reports that China is planning to ban cryptocurrency mining comes as a big blow.

Here is why Bitmain’s senior management will likely spend sleepless nights for the foreseeable future:

-

Its biggest market is gone

Despite a 2017 ban on cryptocurrency trading and initial coin offerings, China has been the world’s biggest market for bitcoin mining hardware.

With the potential ban on cryptocurrency mining in the world’s second-largest economy, sales of Bitmain’s mining hardware are certain to fall. Bitmain has been diversifying lately but the bulk of its revenues still comes from selling bitcoin miners.

-

Bitmain’s Restructuring Plans Derailed

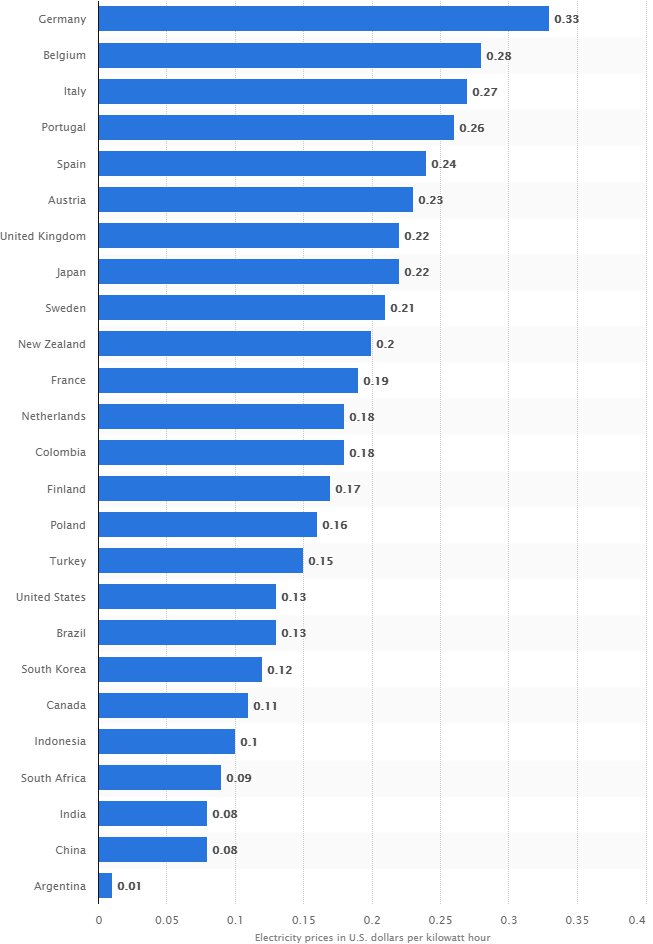

As part of the plans of righting the ship, Bitmain was on the verge of making a serious cryptocurrency mining investment in China. With China possessing one of the cheapest electricity across the globe, this was a no-brainer.

Specifically, Bitmain intended to put up 200,000 units of crypto mining hardware in China at a cost between $80 million and $100 million.

News of the ban will, however, derail these plans and Bitmain will have to scour other locations for cheap electricity. Or cancel its expansion plans altogether.

-

The Mining hardware giant was closing other operations outside China as it looked inward

In what can only be referred to as unfortunate timing, the restructuring that Bitmain has been undergoing in the past few months have seen it reduce its global footprint as it focused on its domestic operations.

This included suspending operations in Texas and by extension a $0.5 billion investment. The investment would have turned the Lone Star State facility into the largest cryptocurrency mining operation in the United States.

Similarly, Bitmain also scaled back its operations in the Netherlands earlier in the year. And last year in December, Bitmain shut down a development center located in Israel.

-

Bitmain’s IPO now looking even more Unattainable

As Bitmain was awaiting the decision of its unsuccessful public listing bid, Charles Li Xiaojia, the CEO of the Hong Kong stock exchange where Bitmain was planning to list warned that consistency and sustainability were key to a successful process.

‘Be Sustainable’: Hong Kong Stock Exchange CEO Scoffs at Crypto Giant Bitmain’s IPO Attempt https://t.co/1weg5JysDz

— CCN.com (@CCNMarkets) January 24, 2019

Now with the threat of losing its largest market in one fell swoop, Bitmain’s chances of an IPO have been put into even more doubt. This is because the ban has only drawn attention to the uncertainty and precariousness of the business Bitmain is in.

-

The competition is heating up

In war and in business, the enemy never sleeps. Even as Bitmain has been scaling back, its Chinese rivals have been doing the opposite.

Ebang, one of Bitmain’s Chinese rivals has already announced plans to expand dramatically this year. Ebang is scheduled to manufacture over 400,000 blockchain processing units in 2019.

Canaan Creative, on the other hand, has been busy looking for funding, no doubt both to finance growth and operations. Per the Securities Times, Canaan Creative recently raised several hundred million dollars.

So is it all doom and gloom for Bitmain? Not really. On the plus side, this could be a good thing for the bitcoin mining giant. The ban could drive the price of bitcoin up and therefore raise interest in cryptocurrency mining. That would boost mining hardware sales. Bitmain will, however, have to fight harder in the market in the face of emboldened rivals.

[ad_2]

Source link