[ad_1]

Ever since the security breach of Coincheck in January 2018, formerly the largest crypto exchange in Japan, local authorities have imposed a stricter process in granting licenses to trading platforms that support Bitcoin and other cryptocurrencies.

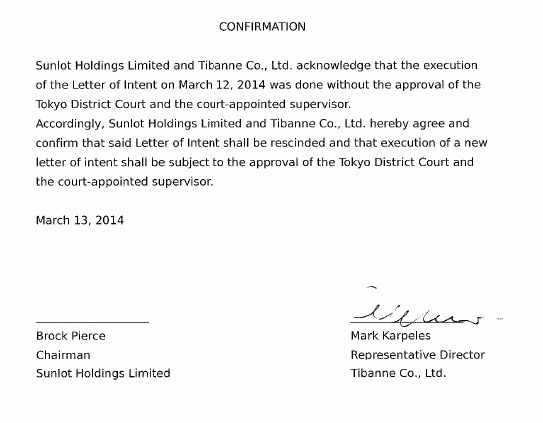

Recently CCN reported that Brock Pierce, the co-founder of Blockchain Capital, disclosed his plans to revive Mt. Gox, an exchange which lost billions of dollars in user funds stored in Bitcoin in 2014.

By distributing $1.2 billion currently held by Mt. Gox and reinstating the company’s operations, Pierce wants to reimburse every creditor of Mt. Gox through a process called Rising Civil Rehabilitation.

But, to operate as a cryptocurrency exchange in Japan, Mt. Gox will have to obtain a license from the FSA. Will the now-defunct cryptocurrency trading platform successfully obtain the approval of the FSA?

It All Depends Whether Mt. Gox Could Distribute $1.2 Billion in Crypto Holdings

The FSA has become significantly more rigorous in approving cryptocurrency exchanges.

Last month, the FSA granted its first license to a cryptocurrency exchange in well over a year to Coincheck, the company that suffered a high-profile hacking attack which ultimately led to the loss of over $600 million in user funds.

Main takeaways from Coincheck press conf:

– only NEM impacted

– plans to continue operating, restart trading

– not clear on plan to repay customers

– no multisig💀

– wouldn’t admit security was weak

– not sure how hacked, if domestic or foreign hackers

– CEO barely spoke— Yuji Nakamura (@ynakamura56) January 26, 2018

It took Coincheck more than 12 months to relaunch and restore its operations after finding an investor that was capable of paying back users that were affected by the security breach.

Monex Group, the parent company of Coincheck, said:

“Coincheck Inc announced today that it has registered with the Kanto Financial Bureau as a cryptocurrency exchange agency in accordance with the Payment Service Act, effective January 11, 2019.”

However, the Mt. Gox case is arguably worse than Coincheck because of the complexities involved.

Currently, Mt. Gox – led by Brock Pierce – is focused on distributing $1.2 billion in Bitcoin to creditors so that the firm can restructure and ready for a relaunch.

The core problem with the Mt. Gox case is that there is a pending $16 billion lawsuit filed against the company by CoinLab which reportedly alleged the Japanese exchange for breaching a contract.

The case is not filed against Mt. Gox but rather against the creditors of Mt. Gox, as Mark Karpeles, the former CEO of the exchange, explained.

In an event in which the court sides with CoinLab and the lawsuit is settled, the amount of compensation Mt. Gox could be ordered to pay will have to be paid for by the creditors.

Simply put, if CoinLab wins the lawsuit, the $1.2 billion holdings of Mt. Gox, which was planned to be distributed to creditors, will have to be used to settle the case.

“This lawsuit today is not CoinLab vs. MtGox, but CoinLab vs. the MtGox customers, now creditors, who have done nothing to deserve being involved in this,” Karpeles said in May 2017.

It Could Take a Long Time For Mt. Gox to Relaunch

Coincheck needed a full year to relaunch and restore its operations even after the company found an investor which promised to reimburse users of the exchange.

The Coincheck case also did not have pending lawsuits or complaints in the magnitude of Mt. Gox that slowed down the process of the restoration of the company.

As of February, there are too many variables involved in Mt. Gox that could prolong the process of relaunching the infamous Bitcoin exchange.

The community has responded positively to the plans of Brock Pierce to lead an initiative that could potentially restore the reputation of the global cryptocurrency sector and reimburse all of the creditors of the exchange.

Hey @brockpierce My losses from MtGox inspired me to create the glass books transparency protocol in 2014 and then launch https://t.co/ZFal4LaVyS to be the most transparent exchange in the world. If you want help in the resurrection let’s talk.https://t.co/NSL3XGEeuM

— Vaultoro J.Scigala (@Vaultoro) February 9, 2019

But, considering the FSA’s tightening of policies surrounding cryptocurrency exchanges and the variables in the Mt. Gox case, it could take a significantly longer time than Coincheck to revive Mt. Gox.

Bitcoin Image from REUTERS / Kim Kyung-Hoon

[ad_2]

Source link