[ad_1]

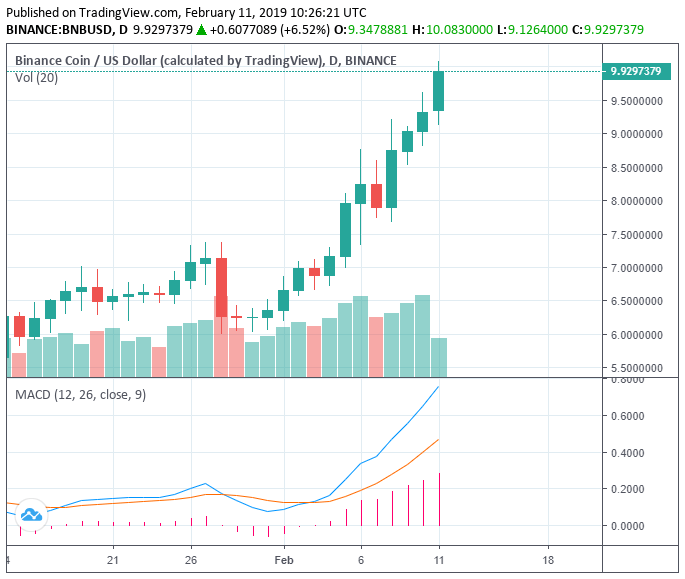

Since January 14, the price of Binance Coin (BNB) has increased from $5.54 to $9.7, by more than 75 percent against the U.S. dollar. In the same time frame, the valuation of the crypto market dropped slightly by $3 billion from $124 billion to $121 billion.

BNB has outperformed the rest of the crypto market by a substantial margin and has become a top 10 cryptocurrency for the first time in its history after recording a 6 percent gain on the day.

What’s Pushing Binance Coin Up and What’s the State of the Crypto Market?

The primary contributing factors of the surge in the price of Binance Coin are fundamental factors such as a decreasing circulating supply, the multi-billion dollar business it represents, the performance of Binance in the bear market, and the prospect of a decentralized exchange.

On January 16, the Binance team burned $9.4 million worth of BNB in a coin burn, eliminating a portion of the circulating supply of the crypto asset.

Changpeng Zhao, the CEO of Binance, said:

“Burn complete. I remember when I did the first burn of $1,500,000 USD equivalent in BNB, I was nervous as hell. Now, well, I am still nervous, lol. Fastest way to spend money.”

The timing of the coin burn and the beginning of a short-term rally of BNB coincided. From January 16, following the successful elimination of 1,623,818 BNB, the price of the asset surged substantially.

Every quarter, Binance burns the circulating supply of BNB using the profits generated by the exchange.

Initially, BNB was issued as a means to finance Binance in the early stages of the company. After its establishment as a top exchange, Binance has been using 20 percent of the firm’s profits to buy back BNB and burn the asset, decreasing the supply of BNB.

“Every quarter, we will use 20% of our profits to buy back BNB and destroy them, until we buy 50% of all the BNB (100MM) back. All buy-back transactions will be announced on the blockchain. We eventually will destroy 100MM BNB, leaving 100MM BNB remaining,” the whitepaper of Binance reads.

Similar to Bitcoin with its halvening once every two years, the price surge of BNB is caused by its declining circulating supply. As the demand for BNB grew and its supply declined, in the past month, the price of BNB increased by more than 75 percent.

From its all-time high, BNB has declined by 61 percent and it remains as the best performing cryptocurrency throughout the bear market.

Traders Lean Bearish on Overall Crypto Market in the Short-Term

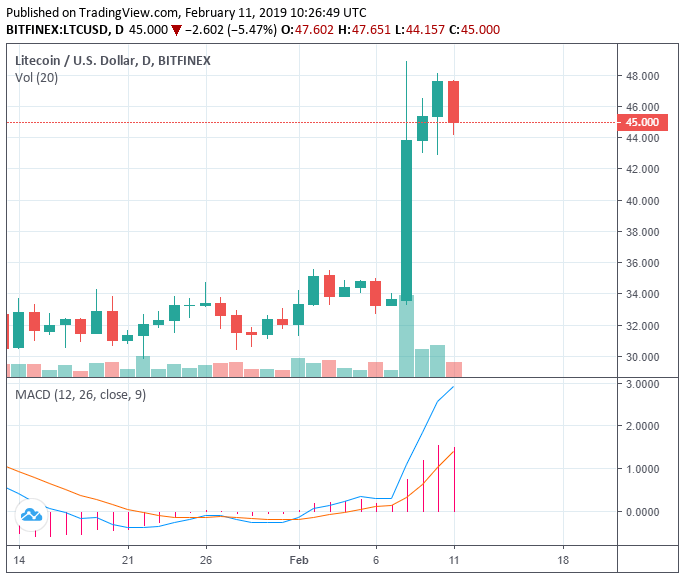

Last week, the crypto market engaged in a strong corrective rally driven by technical factors.

On February 9, the market added $10 billion overnight in a span of several hours, triggering some assets like Litecoin and EOS to surge by more than 20 percent.

However, in the short-term, traders are not convinced that the momentum gained from Saturday can be sustained throughout the weeks to come.

“The daily doesn’t look great IMO. I want to see a HH before getting excited about a HTF market structure shift. We’ve made a HL on the weekly, but we made a HL on a weekly a few times in this bear market. Remember $7.4k, 6.8k etc,” one trader said.

DonAlt, a cryptocurrency trader, also suggested that with the recent pullback of major digital assets, it is of high risk to expect a continuous rally.

“What just happened is what I was talking about, just for ETH. Took out the high and then mega dumped. Taking my longs off on this move back up & waiting it out,” he said.

In the upcoming days, traders expect the market to retrace from its large gains on February 9 if major crypto assets cannot sustain their momentum at current levels.

Featured Image from Shutterstock. Price Charts from TradingView.

[ad_2]

Source link